TaxGPT

About TaxGPT

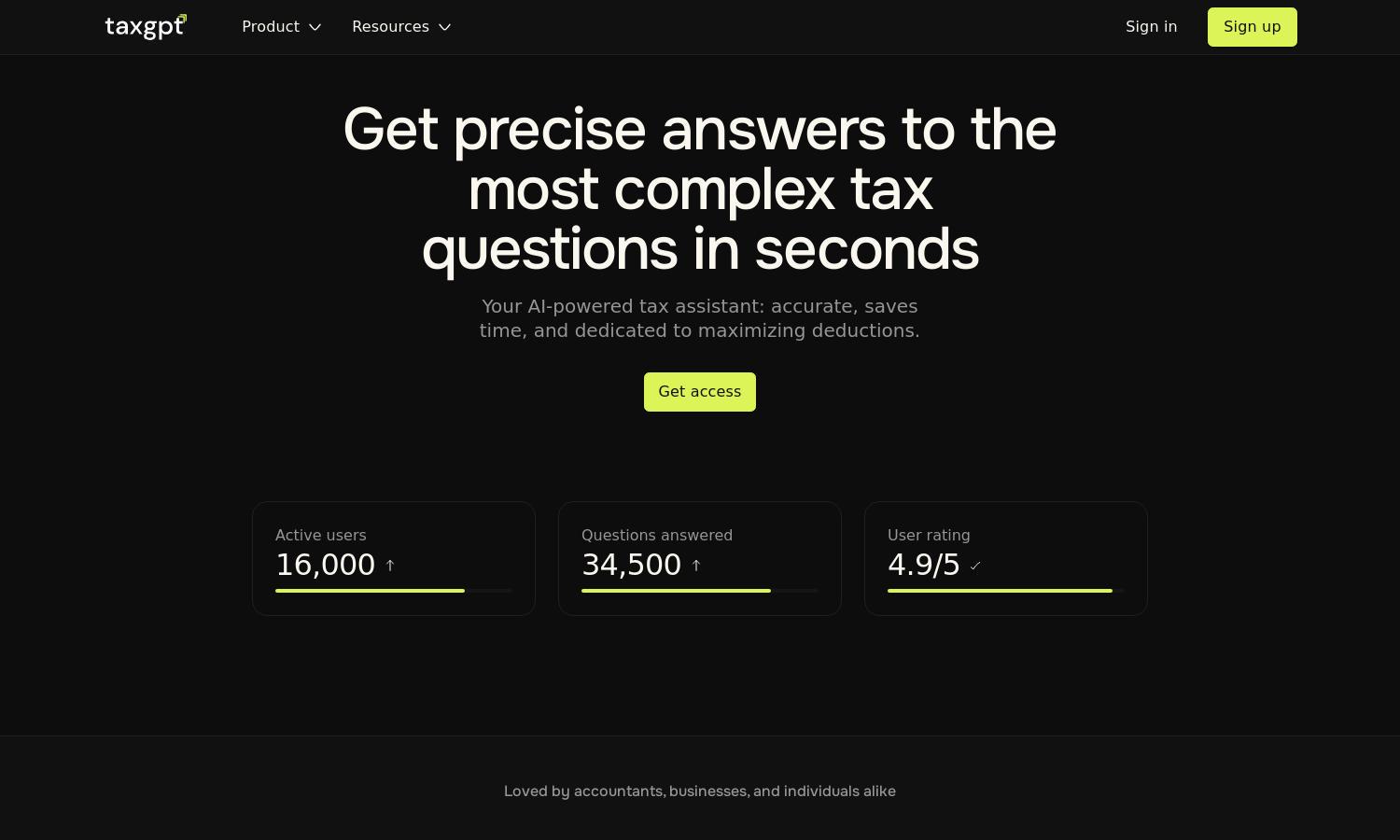

TaxGPT is an innovative AI tax assistant designed for accountants and tax professionals, streamlining tax processes and document management. Its unique co-pilot feature enables users to conduct in-depth research, draft memos, and provide accurate, timely answers to complex tax questions, significantly improving productivity and efficiency.

TaxGPT offers a free 14-day trial with no obligations. Subscription plans vary, providing increasing access to advanced features and resources. Upgrading allows users to maximize the benefits of TaxGPT, ensuring that tax professionals and businesses save time and enhance productivity effectively.

TaxGPT's user interface is designed for seamless navigation, with an intuitive layout that enhances the browsing experience. Its user-friendly features include easy document uploads and quick access to the AI chatbot, ensuring that accountants and clients interact efficiently with the platform.

How TaxGPT works

Users begin their interaction with TaxGPT by signing up and exploring key features designed to enhance their tax-related tasks. The platform allows for easy document uploads and offers instant answers to tax queries. As users navigate, its AI capabilities continuously improve, ensuring accuracy in research, memo writing, and document management.

Key Features for TaxGPT

AI-Powered Tax Research

TaxGPT's AI-powered tax research feature stands out by drastically cutting down research time by 90%. Users can confidently tackle complex tax questions and receive accurate responses, making it an invaluable tool for tax professionals looking to enhance their efficiency and productivity.

Memo Writing Functionality

The memo writing functionality in TaxGPT allows users to create comprehensive tax memos effortlessly. This feature combines efficiency and accuracy, enabling accountants to provide detailed and well-documented advice to clients, ultimately saving time and enhancing service quality.

Maximized Deductions

The maximized deductions feature of TaxGPT ensures users identify all eligible deductions, helping individuals and businesses avoid overpaying taxes. By leveraging comprehensive tax knowledge, this unique offering empowers users to optimize their tax strategies effectively.