finbots.ai

About finbots.ai

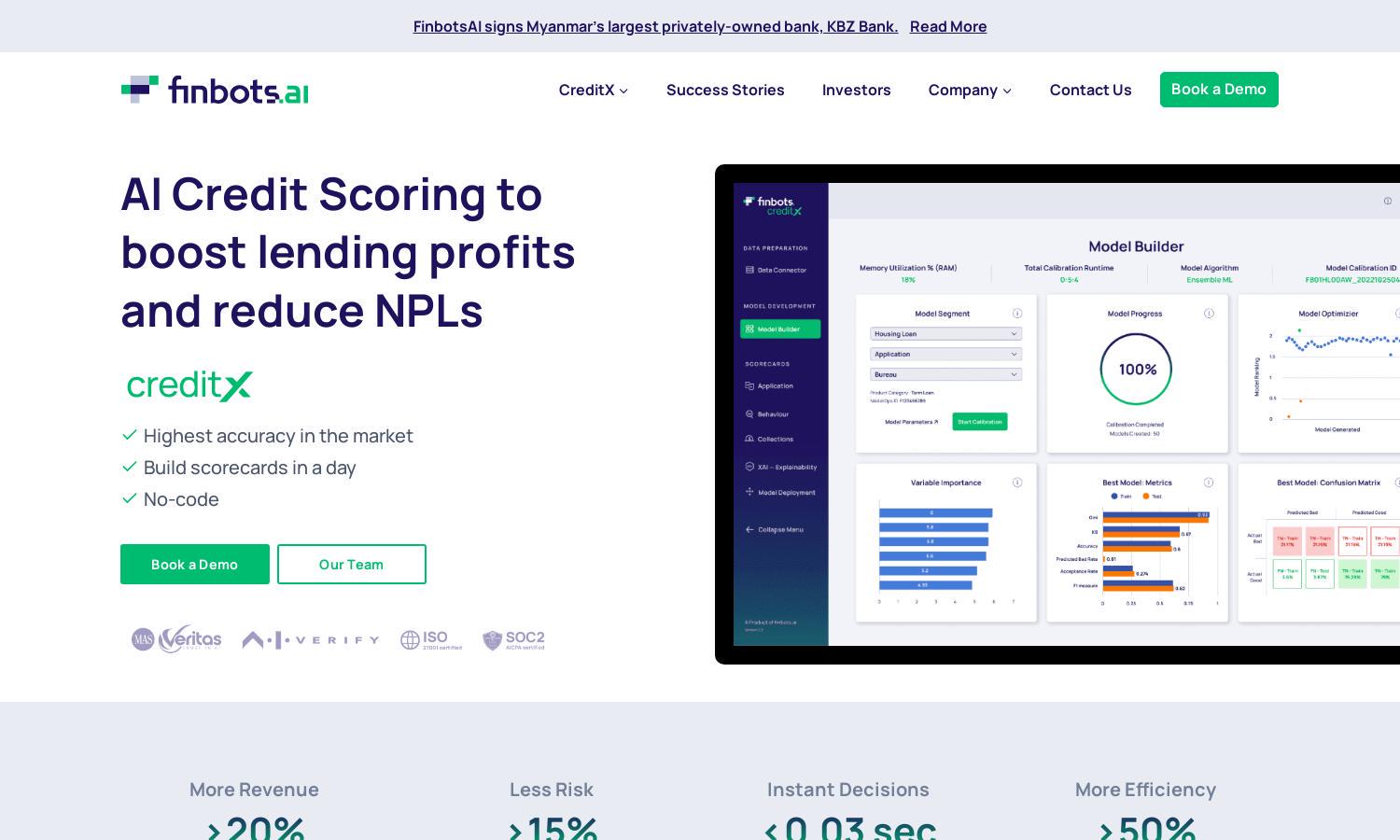

finbots.ai is a premier AI credit risk platform designed for lenders seeking to enhance decision-making and profitability. With its innovative CreditX solution, users can create custom scorecards and deploy them rapidly, enabling smarter lending practices and reducing non-performing loans through highly accurate assessments.

Pricing for finbots.ai includes flexible tiers that cater to various business needs. Users can enjoy a 30% discount for the first six months, enhancing their credit risk management capabilities affordably. Upgrading offers added functionalities and improved access to advanced AI-driven tools for better lending efficiency.

The user interface of finbots.ai is designed to be intuitive and user-friendly, ensuring a seamless experience for clients. With clear navigation and easily accessible features, users can quickly access tools for creating scorecards and deploying AI models, enhancing their overall interaction with the platform.

How finbots.ai works

To use finbots.ai, users begin by onboarding through a simple setup process, connecting their internal and external data sources. Once integrated, they can easily access the CreditX service to build, validate, and deploy AI-driven credit scorecards. The platform's intuitive interface and automation streamline operations, allowing lenders to make faster and more informed decisions, ultimately reducing risks and improving profitability.

Key Features for finbots.ai

Custom Scorecards

finbots.ai’s custom scorecards feature allows lenders to create tailored, highly accurate credit assessments in just one day. This unique capability empowers users to make data-driven decisions quickly, optimizing lending processes and enhancing profitability through advanced AI technology.

Rapid Deployment

The rapid deployment feature of finbots.ai ensures that users can implement their custom credit scorecards instantly. This advantage enables lenders to react swiftly to market changes, enhancing their competitive edge and improving operational efficiency for a quick turnaround on lending decisions.

AI-Driven Decisioning

finbots.ai offers AI-driven decisioning, enabling lenders to make real-time credit assessments within 0.03 seconds. This feature dramatically improves the efficiency of the lending process, allowing clients to serve their customers better with faster and more accurate loan approvals.