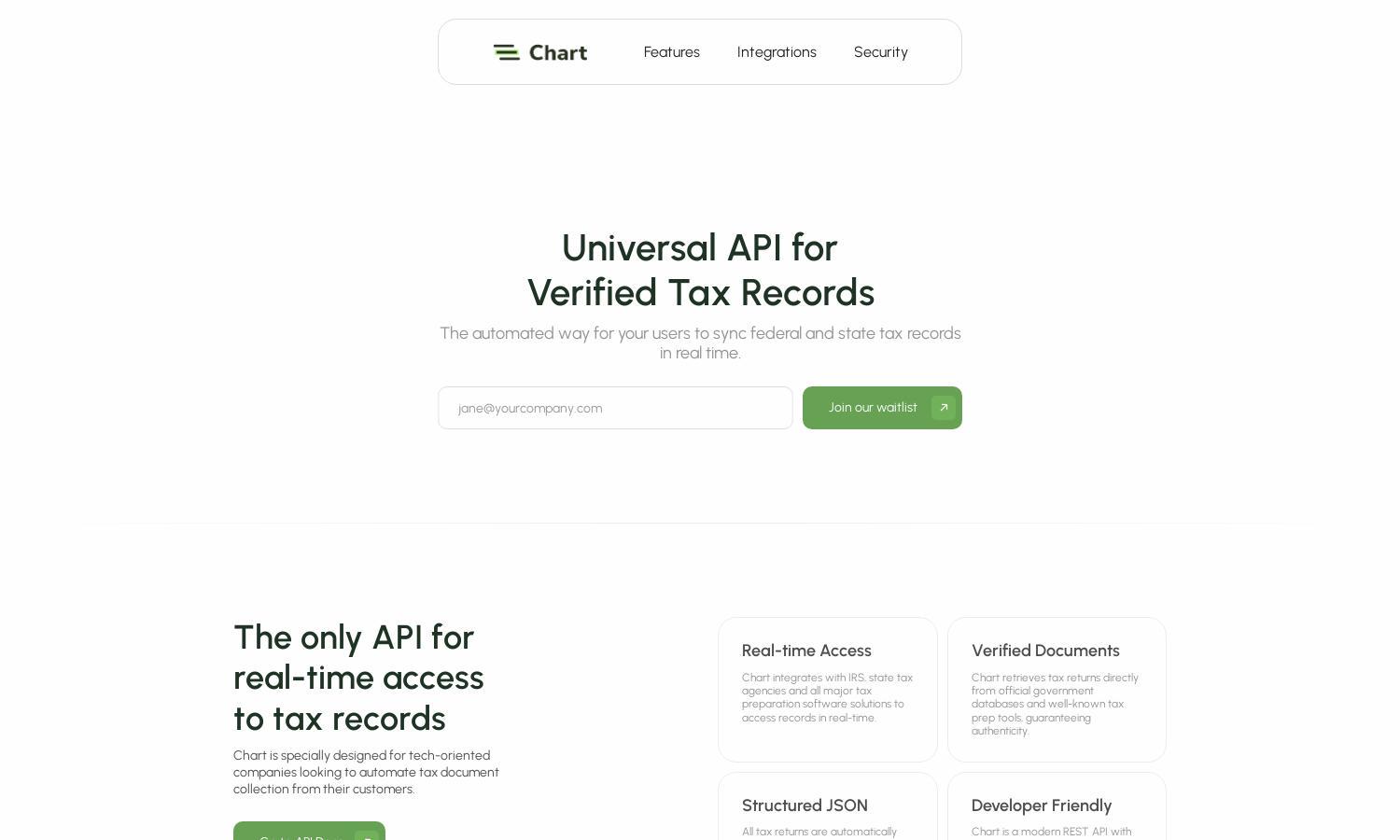

Chart

About Chart

Chart is a pioneering platform designed for tech-oriented companies seeking automation in tax document collection. By providing verified access to real-time tax records from IRS and state agencies, it streamlines compliance. Users benefit from structured JSON outputs and seamless integrations, minimizing errors and enhancing efficiency.

Chart offers flexible pricing tiers designed to accommodate various business needs. Each plan provides unique features like real-time access to tax records and enhanced security options. Upgrading ensures businesses benefit from advanced tools, integration capabilities, and premium support. Explore Chart’s plans to maximize efficiency.

Chart’s user interface is designed for simplicity and efficiency, providing a seamless browsing experience. Intuitive navigation allows users to access essential features quickly. Unique functionalities, such as structured JSON data retrieval and easy document submission, enhance usability, making Chart an ideal tool for tax document automation.

How Chart works

Users begin by onboarding with Chart, creating an account to access the API. The intuitive dashboard guides them through connecting their IRS accounts or tax preparation software. Once linked, users can submit tax records effortlessly. Chart processes these documents in real-time, delivering results in structured JSON, ensuring a smooth and efficient user experience.

Key Features for Chart

Real-time Tax Record Access

Chart’s real-time tax record access feature exemplifies its core functionality, allowing users immediate retrieval of verified tax documents from IRS and state agencies. This unique capability accelerates the process of tax document automation, ensuring businesses can easily gather the necessary information for compliance and decision-making.

Enterprise-grade Security

Chart’s enterprise-grade security ensures user credentials are never persisted, providing peace of mind. Each session requires re-login, significantly reducing the risk of unauthorized access. This focus on security enhances user trust, making Chart a reliable partner for businesses handling sensitive tax information.

Comprehensive Document Submission Options

Chart offers an array of document submission options, catering to user preferences. Users can connect their IRS accounts, utilize tax prep software, or upload PDFs directly. This flexibility simplifies the process and ensures convenient access to necessary tax records, enhancing the overall user experience.

You may also like: